Share & Stock trading

Trade thousands of financial assets across a wide range of classes from a single trading account.

*The pricing is for indicative purposes only. Please click on individual symbols to see trading conditions.

Dynamic leverage applies to MT4, MT5 and cTrader. For more information, visit: https://www.fxpro.com/leverage-information

Why trade with FxPro

15+ Years of Excellence

Choose a trusted broker that serves clients in over 170 countries.

Trade thousands of Instruments

Trade Shares, Futures, Indices, Metals, Energy and other derivatives!

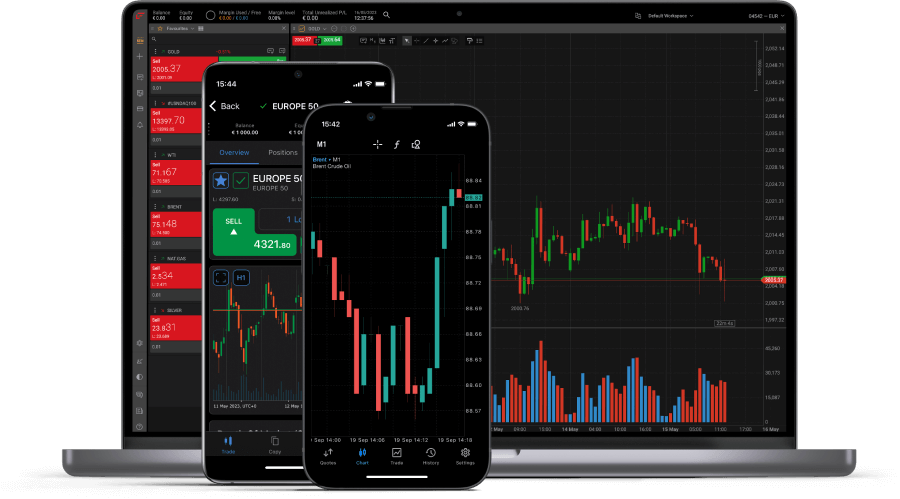

4 Trading Platforms

Trade on your preferred platform including FxPro MT4, MT5, cTrader and Edge

Fast Execution & Deep Liquidity

Benefit from ultra-fast order execution with most orders executed in under 13 ms.

105+ UK & International Awards

Trade with a broker that has been repeatedly recognized for the quality of its services.

24/5 Multilingual Support

Reap the benefits of our 24/5 Customer Support, providing assistance in more than 17 languages.

Award-Winning NDD Execution

All client trades are executed with No Dealing Desk1 intervention. Most trades are filled in under 13 milliseconds, with up to 2,400 trades executed per second.

Most orders filled in

< 13 ms

Up to 2,000 orders executed per second

Ultra-low latency datacentre co-location

Choose Your Platform

We provide our clients with a wide range of desktop, web and mobile trading platforms including MetaTrader 4, MetaTrader 5, cTrader and FxPro Platform.

Compare the features and functionalities of our trading accounts with the Platform Comparison Table.

Learn more about Stock trading with FxPro

Check out our useful educational material and top-notch trading tools.

Get to grips with the basics of online trading with our free interactive trading course.

Find the answers to common trading questions.

Get the latest analysis & trading ideas on thousands of instruments.

Stay up to date with all the company earnings reports and be aware of upcoming dividends and any potential changes to trading conditions.

Automate your trading strategies with low latency Equinix virtual private server from Beeks.

Daily expert reviews from the FxPro Analyst team.

Stay on top of upcoming economic events and the latest data figures.

What Are Shares?

What you need to know about shares

A share is a type of security, that allows an investor to own a part of a company with the right to vote on management issues and to receive profit based on the results of the corporate work.

Shares are divided into two main types.

Ordinary share

Securities give its owner the right to take part in management, as well as to participate in the distribution of dividends. The supreme governing body of an issuer company is the general meeting of shareholders, decisions at which are taken by voting. An owner of one share has one vote at the meeting. Naturally, the holder of 1000 shares will have much more authority than the holder of, for example, 100 papers.

Preferred share

This type of a share guarantees holders an advantage in the distribution of the corporate profits. Dividends are paid first to the holders of preferred shares, and then to the owners of ordinary ones. The same applies to the recovery of losses in an event of bankruptcy. But at the same time, owners of preferred securities are deprived of the right to vote at the shareholder meetings.

Why do companies issue shares

First of all, that is a tool for raising a company’s capital. These are bought with is put straight into the business for instance into the development of its production or restocking its working capital.

Secondly, it is an important reputational component of the corporate image. This adds to its publicity and transparency and attracts potential investors interested in trading. But in order for the securities of a company to be traded on the stock exchange, they must first be listed.

What is a listing

There is a series of procedures that a company needs to go through in order to include its securities into the Stock list. Each stock exchange tries to protect the interests of its investors (those who are interested in stocks trading) and therefore seeks to trade only the strongest issuers. To prove the "quality" of its securities emission, a company has to undergo a series of checks. Requirements might be made to the size of the share capital, its profitability, size of the issue, etc.

Stock price

Each issued share has a so-called nominal value. If a physical document is produced, this value is displayed on the front of the certificate. It is calculated with a simple formula: the total size of the authorized capital of a company is divided by the number of the papers issued. But the nominal value does not reflect the real market quotes during shares trading.

The emission value of a security is determined after it been listed on the stock exchange. Usually, it equals to or is slightly higher than the nominal value. Additionally, depending on the corporate performance, which in turn affects the interest of the investors, the market price will be determined.

Online trading

Stock trading begins with research into finding a broker.

In most developed countries, equity investments are used by people as tools to protect and increase their own savings, so these investments are widely available to anyone. Some prefer to invest money in stocks of reliable companies that show stable growth and pay dividends. Other investors prefer to buy shares online to get involved in speculation: looking for potentially undervalued securities, buying them cheap and selling them later at a higher price. But both of these investment directions take place in their country and are the driving force of the national economy.

A World of Opportunities

Trade thousands of financial assets across a wide range of classes from a single trading account.