Spot indices trading

Invest in popular Indices from across Europe, Asia and America.

| Markets | Sell | Buy | Change, % |

|---|

| Markets | Sell | Buy | Change, % |

|---|

*The pricing is for indicative purposes only. Please click on individual symbols to see trading conditions.

Dynamic leverage applies to MT4, MT5 and cTrader. For more information, visit: https://www.fxpro.com/leverage-information

Why trade with FxPro

15+ Years of Excellence

Choose a trusted broker that serves clients in over 170 countries.

Trade thousands of Instruments

Trade Shares, Futures, Indices, Metals, Energy and other derivatives!

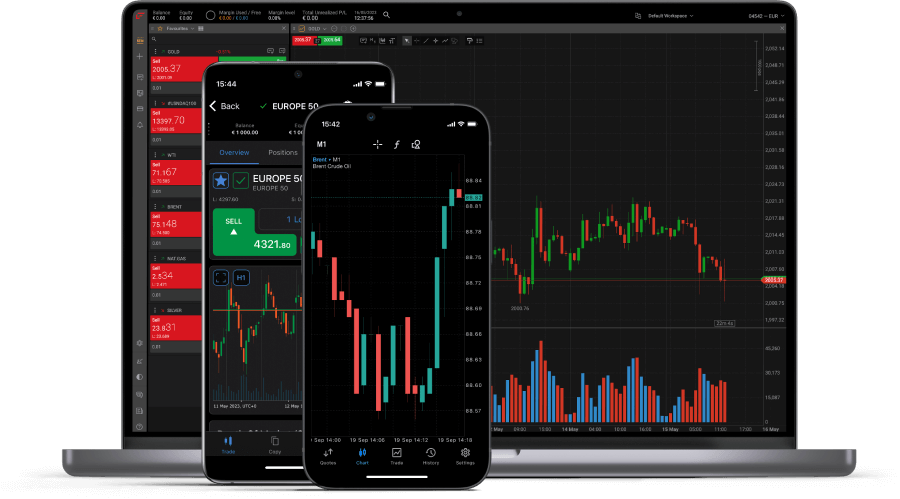

4 Trading Platforms

Trade on your preferred platform including FxPro MT4, MT5, cTrader and Edge

Fast Execution & Deep Liquidity

Benefit from ultra-fast order execution with most orders executed in under 13 ms.

105+ UK & International Awards

Trade with a broker that has been repeatedly recognized for the quality of its services.

24/5 Multilingual Support

Reap the benefits of our 24/5 Customer Support, providing assistance in more than 17 languages.

Award-Winning NDD Execution

All client trades are executed with No Dealing Desk1 intervention. Most trades are filled in under 13 milliseconds, with up to 2,400 trades executed per second.

Most orders filled in

< 13 ms

Up to 2,000 orders executed per second

Ultra-low latency datacentre co-location

Choose Your Platform

We provide our clients with a wide range of desktop, web and mobile trading platforms including MetaTrader 4, MetaTrader 5, cTrader and FxPro Platform.

Compare the features and functionalities of our trading accounts with the Platform Comparison Table.

Learn more about Index trading with FxPro

Check out our useful educational material and top-notch trading tools.

Get to grips with the basics of online trading with our free interactive trading course.

Find the answers to common trading questions.

Learn the differences between Dow Jones, NASDAQ and S&P500.

Stay up to date with all the company earnings reports and be aware of upcoming dividends and any potential changes to trading conditions.

Automate your trading strategies with low latency Equinix virtual private server from Beeks.

Daily expert reviews from the FxPro Analyst team.

Get the latest analysis & trading ideas on thousands of instruments.

Stay on top of upcoming economic events and the latest data figures.

What Are Indices?

World indices are indicators of price changes for a certain group of securities. The stock exchange index can be explained as a “basket” of shares united by a common basis. Trading indices can be compared to opening positions on the courses of several dozen stocks at once.

The most important thing is determining the exact stocks or bonds each index is formed from. The set of shares included in the spot index value calculation determines the information that can be obtained by observing the dynamics of its course.

In general, the main purpose of world indices is to create a powerful indicator for investors to characterise the direction of companies’ quotes in a particular industry. Studying the dynamics of major indices helps to understand the impact of certain events on the value of securities.

During trading indices, keep in mind that the reaction to the economic news published may not correspond with expectations and forecasts.

For example, if there is a rise in oil prices, it is logical to expect an increase in the shares of all the oil companies.

However, different stocks grow at different speeds, while some of them may not respond to such news at all. In this case, the spot index helps traders to understand the overall trend of this market segment without the need to assess the position of lots of different companies.

Observation and trading indices give insights into how the different sectors of the economy trade in comparison with each other. Here at FxPro we are glad to offer the trading on major index derivatives on major indices, which makes it possible to join the price movement not only for a rise, but also a fall.

Trading indices is popular among FxPro traders due to its comprehensive terms, accurate quotes from several suppliers and versatile analytics. After all, in order to understand the logic of the index behaviour, you need to pay attention to the corporate news of each of the companies included, as well as on events affecting the wider industry as a whole.

A World of Opportunities

Trade thousands of financial assets across a wide range of classes from a single trading account.